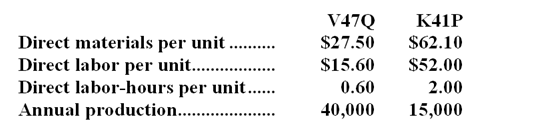

Solum Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs) . The company has two products, V47Q and K41P, about which it has provided the following data:  The company's estimated total manufacturing overhead for the year is $2,449,440 and the company's estimated total direct labor-hours for the year is 54,000.

The company's estimated total manufacturing overhead for the year is $2,449,440 and the company's estimated total direct labor-hours for the year is 54,000.

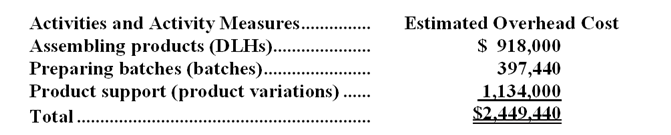

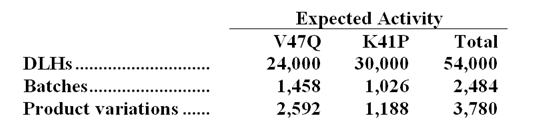

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

-The unit product cost of product V47Q under the company's traditional costing system is closest to:

Definitions:

Q20: The activity variance for administrative expenses in

Q20: What was the absorption costing net operating

Q24: The materials quantity variance for November is:<br>A)$9,600

Q68: The break-even point in unit sales increases

Q73: Planning and control are essentially the same

Q96: Wecker Corporation uses the following activity rates

Q130: Roskam Housecleaning provides housecleaning services to its

Q153: UHF Antennas,Inc. ,produces and sells a unique

Q172: The total cost at the activity level

Q205: The direct materials in the flexible budget