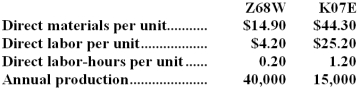

Bustle Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs).The company has two products,Z68W and K07E,about which it has provided the following data:

The company's estimated total manufacturing overhead for the year is $1,809,600 and the company's estimated total direct labor-hours for the year is 26,000.

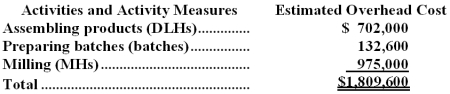

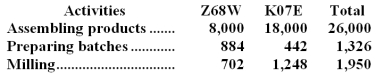

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

Required:

a.Determine the unit product cost of each of the company's two products under the traditional costing system.

b.Determine the unit product cost of each of the company's two products under activity-based costing system.

Definitions:

Profit Margins

The percentage of revenue that remains as profit after all expenses have been deducted from sales.

Special Product Cost Projects

Involves the detailed analysis and calculation of costs associated with creating a product that is unique or outside the standard product line.

Cost Driver

A factor that influences or contributes to the expense of certain business operations.

Cost Pools

Groups of individual costs that are combined to allocate to cost objects, making the allocation process simpler and more standardized.

Q19: The net operating income in the flexible

Q24: Under variable costing,costs that are treated as

Q55: James Company has a margin of safety

Q62: The direct materials in the flexible budget

Q72: What is the overhead cost assigned to

Q95: In the selling and administrative budget,the non-cash

Q130: The net operating income in the planning

Q156: The spending variance for selling and administrative

Q162: The activity variance for personnel expenses in

Q171: Zylka Air uses two measures of activity,flights