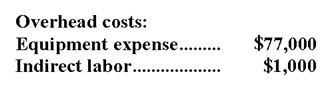

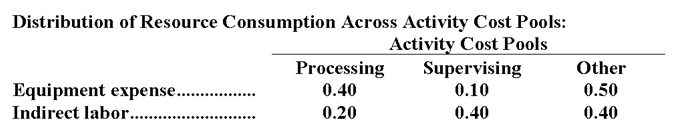

Traughber Corporation uses an activity based costing system to assign overhead costs to products. In the first stage, two overhead costs-equipment expense and indirect labor-are allocated to the three activity cost pools-Processing, Supervising, and Other-based on resource consumption. Data to perform these allocations appear below:

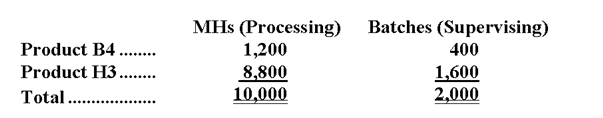

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

-How much overhead cost is allocated to the Processing activity cost pool under activity-based costing in the first stage of allocation?

Definitions:

Q7: The total gross margin for the month

Q16: The manufacturing overhead that would be applied

Q19: What is the unit product cost for

Q29: The unit product cost under variable costing

Q30: How much cost,in total,would be allocated in

Q37: What is the overhead cost assigned to

Q101: The break-even point in units for the

Q154: The product line segment margin for Product

Q183: The spending variance for direct materials in

Q189: The break-even point in unit sales is