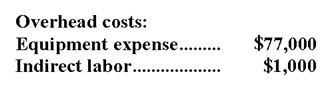

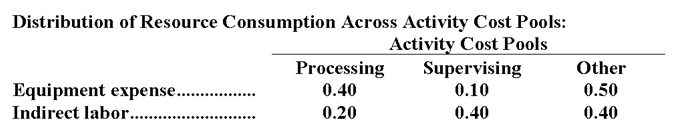

Traughber Corporation uses an activity based costing system to assign overhead costs to products. In the first stage, two overhead costs-equipment expense and indirect labor-are allocated to the three activity cost pools-Processing, Supervising, and Other-based on resource consumption. Data to perform these allocations appear below:

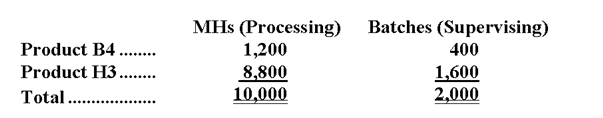

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

-The activity rate for the Processing activity cost pool under activity-based costing is closest to:

Definitions:

Labour Force

The total number of people who are available to work in an economy, including both the employed and the unemployed who are seeking employment.

Employment Insurance

A government program that provides temporary financial assistance to unemployed workers.

Company Pension Plan

A retirement savings program provided by an employer, offering employees a fixed payout upon retirement based on their earnings history, tenure, and age.

Psychological Counselling

Professional guidance provided by a psychologist focusing on resolving personal or psychological challenges.

Q2: An action analysis report provides more detail

Q29: Both variable and fixed manufacturing overhead costs

Q53: The activity variance for direct labor in

Q87: In activity-based costing,some manufacturing costs may be

Q104: The desired ending inventory of Material A

Q112: Variable manufacturing overhead costs are treated as

Q164: The unit product cost under variable costing

Q172: Calderon Corporation produces and sells a single

Q178: Under absorption costing,the unit product cost is:<br>A)$9<br>B)$12<br>C)$13<br>D)$16

Q184: The contribution margin ratio is:<br>A)70%<br>B)45%<br>C)75%<br>D)55%