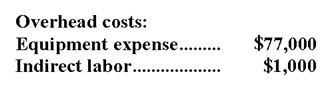

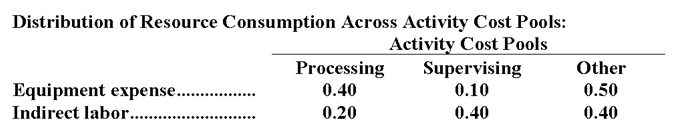

Traughber Corporation uses an activity based costing system to assign overhead costs to products. In the first stage, two overhead costs-equipment expense and indirect labor-are allocated to the three activity cost pools-Processing, Supervising, and Other-based on resource consumption. Data to perform these allocations appear below:

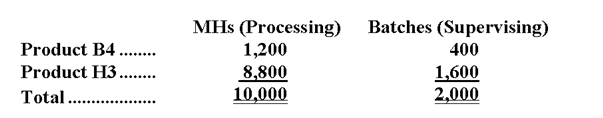

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

-What is the overhead cost assigned to Product B4 under activity-based costing?

Definitions:

Sever

To cut off or divide, often used in legal contexts to discuss separating parts of contracts or severing ties between entities.

Estate in Land

Refers to the degree, quantity, nature, and extent of interest a person has in real property.

Fee Simple

The most complete form of ownership of real estate, giving the holder full possession and control over the property.

Leasehold

An estate or interest in property held under a lease, granting the holder the right to use and occupy the property for a specified period under certain conditions.

Q7: What would be the total overhead cost

Q13: The manufacturing overhead that would be applied

Q17: The activity variance for net operating income

Q64: Segmented statements for internal use should be

Q69: The total volume in sales dollars that

Q110: Rizza Tech is a for-profit vocational school.The

Q152: During March,Samorano Clinic plans for an activity

Q188: The carrying value on the balance sheet

Q188: The break-even in monthly unit sales is

Q233: Crovo Corporation uses customers served as its