Dykema Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools-Processing, Supervising, and Other. The costs in those activity cost pools appear below:  Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

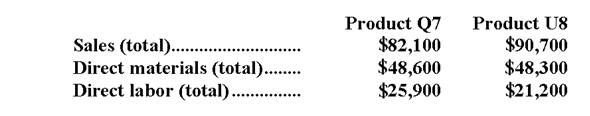

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below: Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

-The activity rate for the Processing activity cost pool under activity-based costing is closest to:

Definitions:

Ambiguous Priorities

Situations where the importance or order of objectives, tasks, or goals is unclear or confusing, often leading to indecision or conflict.

Socio-Economic View

A perspective that considers both social and economic factors in the analysis of situations.

Maximize Profits

The process of increasing the financial gain a business receives from its operations to the highest possible level.

Corporate Boards

Groups of individuals elected by shareholders to oversee the management and make strategic decisions for a corporation.

Q6: The following data have been taken from

Q32: Randall Company is a merchandising company that

Q35: Accounts payable at the end of December

Q82: A proposal has been made that will

Q101: If the company plans to sell 670,000

Q134: Reach Consulting Corporation has its headquarters in

Q150: If Madengrad Company achieves a sales and

Q152: During March,Samorano Clinic plans for an activity

Q220: Bolick Midwifery's cost formula for its wages

Q282: The activity variance for manufacturing overhead in