Dykema Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools-Processing, Supervising, and Other. The costs in those activity cost pools appear below:  Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

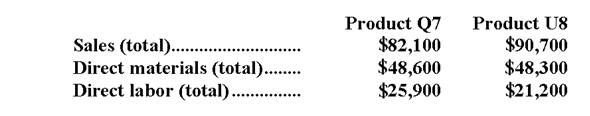

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below: Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

-What is the overhead cost assigned to Product Q7 under activity-based costing?

Definitions:

Effective Date

The date on which an agreement, policy, or regulation becomes enforceable or active.

Securities Act Of 1933

A U.S. federal law enacted to ensure transparency and fairness in the issuance of securities, requiring registration and disclosure to protect investors.

Promissory Note

A written, legally binding agreement in which one party promises to pay a defined sum of money to another party under specified conditions.

SEC

The U.S. Securities and Exchange Commission, a government agency responsible for regulating the securities industry and protecting investors.

Q7: The activity variance for cleaning equipment and

Q13: To the nearest whole dollar,how much wages

Q19: The net operating income in the flexible

Q44: The net operating income in the planning

Q63: Galligan Corporation bases its budgets on the

Q72: The break-even in monthly dollar sales is

Q111: This question is to be considered independently

Q131: During April,Division D of Carney Company had

Q131: The activity variance for wages and salaries

Q231: The following monthly data in contribution format