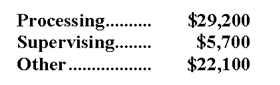

Groch Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools-Processing, Supervising, and Other. The costs in those activity cost pools appear below:  Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

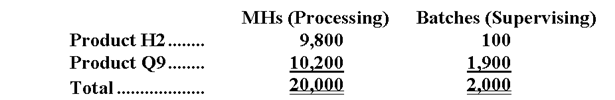

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:  Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

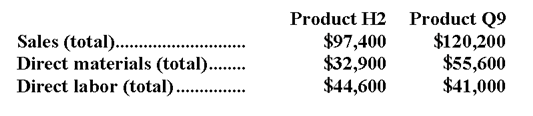

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

-What is the product margin for Product Q9 under activity-based costing?

Definitions:

Degrees of Freedom

The number of values in the final calculation of a statistic that are free to vary.

Null Hypothesis

A hypothesis that asserts there is no significant difference or effect and serves as the default assumption to be tested against an alternative hypothesis.

Chi-square Statistic

A statistical test used to determine if there's a significant difference between observed frequencies and expected frequencies in categorical data.

Degrees of Freedom

The number of independent pieces of information used in the calculation of a statistic, often associated with the complexity of the data.

Q5: Bustle Manufacturing Corporation has a traditional costing

Q8: The overhead cost per unit of Product

Q49: Shown below is the sales forecast for

Q60: What was the absorption costing net operating

Q61: The company plans to sell 38,000 units

Q145: Assume the company's monthly target profit is

Q163: The administrative expenses in the planning budget

Q165: East Company manufactures and sells a single

Q216: The margin of safety as a percentage

Q227: If the company wants to increase its