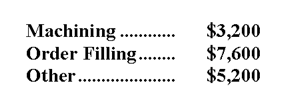

Goold Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools-Machining, Order Filling, and Other. The costs in those activity cost pools appear below:  Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

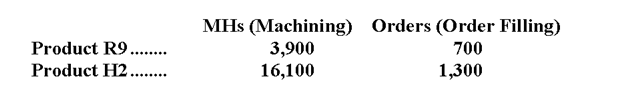

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:  Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.

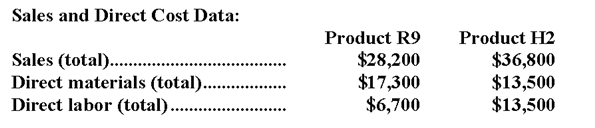

Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.

-What is the overhead cost assigned to Product R9 under activity-based costing?

Definitions:

Product-Level Costs

Expenses directly tied to specific products, including costs for materials and labor required to produce these products, as well as costs associated with specific product designs or customized orders.

Traditional Costing System

An accounting method that allocates overhead costs to products based on a predetermined overhead rate.

Activity-Based Costing System

A costing methodology that assigns manufacturing overhead costs to products based on the activities and resources that go into producing them.

Unit Product Costs

The cost assigned to each unit of product, which includes direct materials, direct labor, and allocated manufacturing overhead.

Q10: Kuechle Manufacturing Corporation has a traditional costing

Q13: Which of the following statements is not

Q20: Maccarone Corporation has provided the following data

Q23: The facility expenses in the flexible budget

Q54: Balonek Inc.'s contribution margin ratio is 57%

Q71: Voytek Corporation bases its budgets on the

Q81: Hirt Corporation sells its product for $12

Q94: Managing and sustaining product diversity requires many

Q103: Veltri Corporation is working on its direct

Q236: The break-even point in sales dollars is:<br>A)$731,250<br>B)$676,000<br>C)$675,000<br>D)$720,000