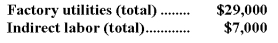

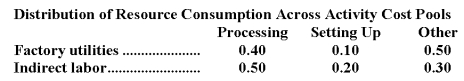

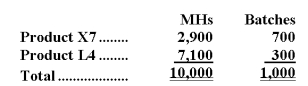

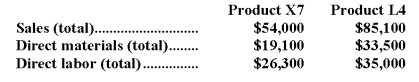

Murri Corporation has an activity-based costing system with three activity cost pools-Processing,Setting Up,and Other.The company's overhead costs,which consist of factory utilities and indirect labor,are allocated to the cost pools in proportion to the activity cost pools' consumption of resources.Costs in the Processing cost pool are assigned to products based on machine-hours (MHs)and costs in the Setting Up cost pool are assigned to products based on the number of batches.Costs in the Other cost pool are not assigned to products.Data concerning the two products and the company's costs and activity-based costing system appear below:

Required:

a.Assign overhead costs to activity cost pools using activity-based costing.

b.Calculate activity rates for each activity cost pool using activity-based costing.

c.Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

d.Determine the product margins for each product using activity-based costing.

Definitions:

Greater Objectivity

The practice or quality of being objective, unbiased, and not influenced by personal feelings or preconceptions.

Confidentiality

The practice of keeping sensitive information secret and protected from unauthorized disclosure.

Executive Coach

A professional who helps executives develop their leadership skills, decision-making, and career paths.

Months

Units of time in calendars that approximate the period required for the moon to orbit the Earth, typically used to measure duration or ages.

Q12: A product sells for $20 per unit

Q42: Activity rates from Quattrone Corporation's activity-based costing

Q69: Youd Corporation uses an activity-based costing system

Q84: Hubiak Corporation produces a single product and

Q102: If the company has budgeted to sell

Q156: If the number of units produced exceeds

Q158: The contribution margin ratio is:<br>A)12.5%<br>B)33.0%<br>C)25.0%<br>D)37.5%

Q167: Sugiki Corporation has two divisions: the Alpha

Q168: If the company sells 2,100 units,its total

Q202: The company's break-even in bundles is closest