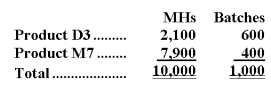

Irie Corporation has an activity-based costing system with three activity cost pools-Machining,Setting Up,and Other.The company's overhead costs have already been allocated to the cost pools and total $18,900 for the Machining cost pool,$20,500 for the Setting Up cost pool,and $23,600 for the Other cost pool.Costs in the Machining cost pool are assigned to products based on machine-hours (MHs)and costs in the Setting Up cost pool are assigned to products based on the number of batches.Costs in the Other cost pool are not assigned to products.Data concerning the two products appear below:  Required:

Required:

a.Calculate activity rates for each activity cost pool using activity-based costing.

b.Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

Definitions:

Measurable Outcomes

Specific, quantifiable results or achievements that can be used to assess the success or impact of a project, program, or activity.

Evaluation Process

A systematic method to assess the value, performance, or quality of something through analysis and review.

Larger Changes

Significant modifications or transformations in a situation, system, or organization, often requiring substantial time or resources.

Routine Work

Tasks or activities that are considered ordinary or standard, typically carried out on a regular basis.

Q7: How much overhead cost is allocated to

Q21: The unit product cost under absorption costing

Q21: Puchalla Corporation sells a product for $230

Q47: What is the company's degree of operating

Q96: The contribution margin is viewed as a

Q105: If Eagle had sold only 9,000 tables

Q128: The contribution margin of the Commercial business

Q155: The amount by which a company's sales

Q170: Rickers Inc.produces and sells two products.Data concerning

Q177: The company's unit contribution margin is closest