Pressler Corporation's Activity-Based Costing System Has Three Activity Cost Pools-Machining,Setting

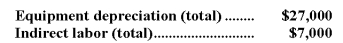

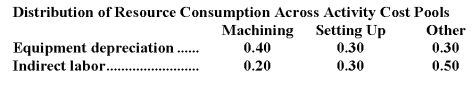

Pressler Corporation's activity-based costing system has three activity cost pools-Machining,Setting Up,and Other.The company's overhead costs,which consist of equipment depreciation and indirect labor,are allocated to the cost pools in proportion to the activity cost pools' consumption of resources.

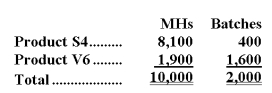

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs)and costs in the Setting Up cost pool are assigned to products based on the number of batches.Costs in the Other cost pool are not assigned to products.

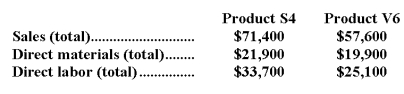

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs)and costs in the Setting Up cost pool are assigned to products based on the number of batches.Costs in the Other cost pool are not assigned to products.  Additional data concerning the company's products appears below:

Additional data concerning the company's products appears below:

Required:

a.Assign overhead costs to activity cost pools using activity-based costing.

b.Calculate activity rates for each activity cost pool using activity-based costing.

c.Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

d.Determine the product margins for each product using activity-based costing.

Definitions:

Imitation

The action of copying or mimicking the behaviors, actions, or appearance of others as a means of learning or social interaction.

3-Week-Old Infant

An extremely young baby who is in the early stages of development, characterized by rapid growth and changes.

Tongue

A muscular organ in the mouth of most vertebrates that manipulates food for chewing and swallowing and is also used for taste and phonetic articulation.

Concrete Operational

A stage in Piaget's theory of cognitive development, typically occurring between ages 7 and 12, where children develop logical thinking but still struggle with abstract concepts.

Q2: The total fixed cost at the activity

Q33: Petitte Corporation has provided the following data

Q33: The total Pediatrics Department cost after the

Q36: The spending variance for expendables in June

Q45: If the budgeted direct labor time for

Q53: To reach a target net operating income

Q171: The contribution margin per unit during July

Q173: The activity variance for net operating income

Q202: During January,Agron Clinic plans for an activity

Q278: The activity variance for administrative expenses in