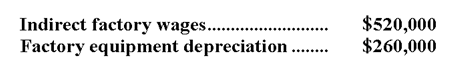

Lehner Corporation has provided the following data from its activity-based costing accounting system:  Distribution of Resource Consumption across Activity Cost Pools:

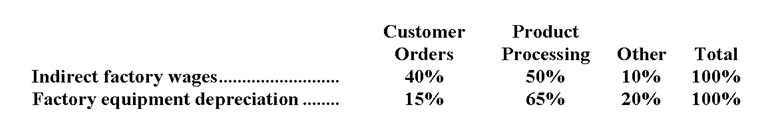

Distribution of Resource Consumption across Activity Cost Pools:

Activity Cost Pools  The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products.

-How much indirect factory wages and factory equipment depreciation cost would NOT be assigned to products using the activity-based costing system?

Definitions:

Goods

Physical items that are produced or purchased for sale.

Services

Intangible products such as expertise, assistance, or access to resources provided by businesses or professionals.

Accounting Period

A specific time period for which financial records and statements are prepared for a business or organization.

One Quarter

A term referring to one-fourth of a year, used in financial and business contexts to divide the fiscal or calendar year into four periods for reporting purposes.

Q4: The break-even point in unit sales for

Q28: Welnor Industrial Gas Corporation supplies acetylene

Q37: Victorin Corporation has provided the following data

Q57: National Telephone company has been forced by

Q77: Net operating income under variable costing would

Q80: How much overhead cost is allocated to

Q91: What is the net operating income for

Q104: What is the unit product cost for

Q209: The medical supplies in the flexible budget

Q219: Sammartino Clinic uses patient-visits as its measure