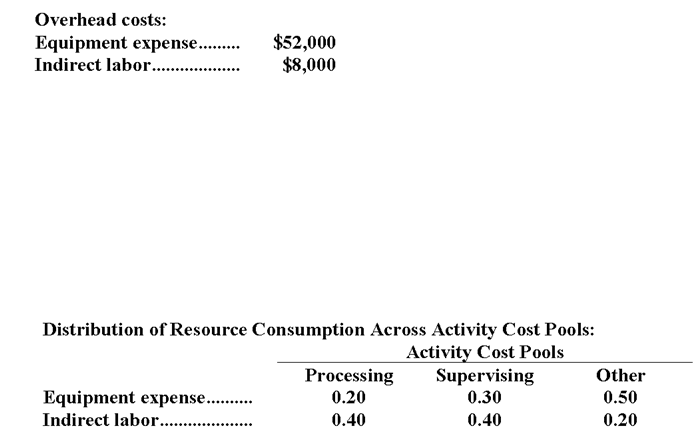

Roshannon Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts-equipment expense and indirect labor-to three activity cost pools-Processing, Supervising, and Other-based on resource consumption. Data to perform these allocations appear below:  In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:

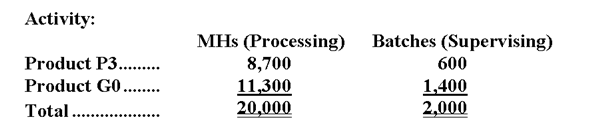

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:  Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

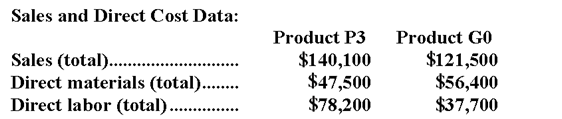

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

-How much overhead cost is allocated to the Processing activity cost pool under activity-based costing in the first stage of allocation?

Definitions:

Hyper-Masculinity

An exaggeration of male stereotypical behavior, emphasizing strength, aggression, and sexuality.

Hierarchical Structure

An organizational framework where entities are ranked one above the other according to authority or status.

Nondeployed Family Members

Relatives of military personnel who remain at home while the military member is deployed overseas or to conflict zones.

Deployment

The act of sending out individuals or resources to their designated locations or missions, often used in military, software, or strategic contexts.

Q3: Stuchlik Catering uses two measures of activity,jobs

Q12: The unit product cost of product F91I

Q13: Ekmark Corporation uses the following activity rates

Q21: Puchalla Corporation sells a product for $230

Q42: The company's net operating income for the

Q89: Assuming that all of the costs listed

Q178: Under absorption costing,the unit product cost is:<br>A)$9<br>B)$12<br>C)$13<br>D)$16

Q208: The net operating income in the planning

Q213: Data concerning Maline Corporation's single product appear

Q293: Velazques Jeep Tours operates jeep tours in