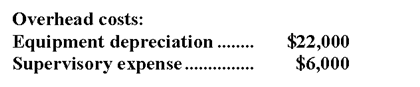

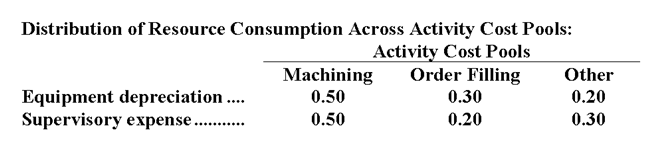

Brisky Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts-equipment depreciation and supervisory expense-to three activity cost pools-Machining, Order Filling, and Other-based on resource consumption. Data to perform these allocations appear below:

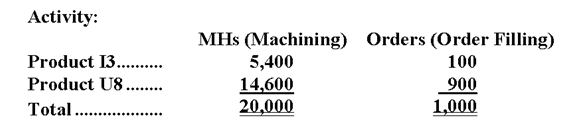

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products.

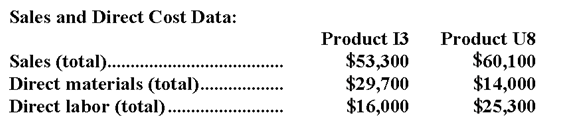

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products.  Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.

Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.

-What is the product margin for Product I3 under activity-based costing?

Definitions:

Import Quotas

Restrictions set by a country on the amount or volume of goods that can be imported into the country over a set period of time.

Consumer Surplus

The discrepancy between what consumers are prepared to spend on a good or service and what they end up paying.

Total Surplus

The sum of consumer surplus and producer surplus in a market, representing the total benefits to society from trading goods and services.

Tariffs

Taxes imposed by a government on imported goods and services to control trade volumes, protect domestic industries, or generate revenue.

Q11: The salary paid to a store manager

Q37: Victorin Corporation has provided the following data

Q40: The desired ending inventory for August is:<br>A)540

Q71: If the budgeted direct labor cost for

Q77: Findt & Thompson PLC,a consulting firm,uses an

Q124: The activity variance for selling and administrative

Q183: The spending variance for direct materials in

Q191: The net operating income in the planning

Q206: The contribution margin per chair for the

Q260: Blockmon Hospital bases its budgets on patient-visits.The