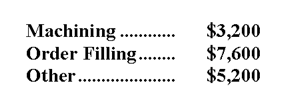

Goold Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools-Machining, Order Filling, and Other. The costs in those activity cost pools appear below:  Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

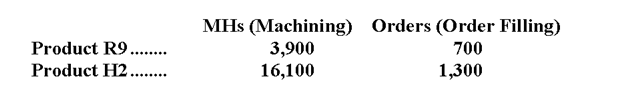

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:  Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.

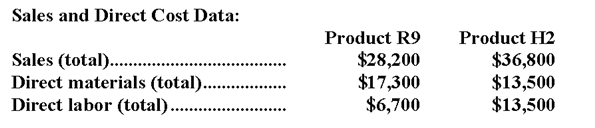

Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.

-What is the product margin for Product R9 under activity-based costing?

Definitions:

Capital Gains

Capital gains are the profits realized from the sale of assets, such as stocks or real estate, when the selling price exceeds the original purchase price.

Significant Influence

A level of power that allows an entity to affect the decision-making of another entity without full control, often associated with ownership of a significant but not majority share percentage.

Significantly Influenced

A situation where an entity has a notable but not controlling interest in another entity, impacting its financial and operating policies.

Associate

An entity in which an investing entity has significant influence, typically through owning a substantial but not majority shareholding, usually between 20% and 50%.

Q6: The medical supplies in the flexible budget

Q25: The total Customer Solutions Department cost after

Q31: How much cost,in total,would be allocated in

Q56: Data concerning three of the activity cost

Q59: Sinclair Company's single product has a selling

Q77: The margin of safety percentage is:<br>A)45.0%<br>B)71.4%<br>C)55.0%<br>D)25.0%

Q98: The degree of operating leverage is closest

Q122: Alongi Corporation uses the following activity rates

Q145: Mish Clinic bases its budgets on patient-visits.During

Q151: In responsibility accounting,each segment in an organization