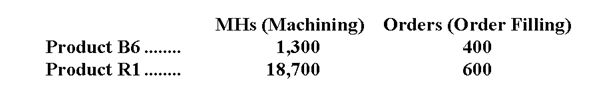

Ormond Corporation uses activity-based costing to assign overhead costs to products. Overhead costs have already been allocated to the company's three activity cost pools as follows: Machining, $6,800; Order Filling, $10,700; and Other, $4,500. Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

-The activity rate for the Machining activity cost pool under activity-based costing is closest to:

Definitions:

Profit and Loss Ratios

Financial metrics that analyze a company's profitability, efficiency, and performance by comparing various figures from the profit and loss statement.

Capital Account Balances

The net result of public and private international investments flowing in and out of a country, including financial and capital assets.

Partnership Liquidation

The process of winding up a partnership's operations, distributing its assets to creditors and shareholders, and terminating its existence.

Legal Action

A formal proceeding in a court of law where a party seeks a legal remedy, such as the enforcement of rights, redress of grievances, or settlement of disputes.

Q77: Net operating income under variable costing would

Q99: The manufacturing overhead budget at Latronica Corporation

Q114: The selling and administrative expense in the

Q136: What is the margin of safety in

Q157: Hassick Corporation produces and sells a single

Q170: Rickers Inc.produces and sells two products.Data concerning

Q173: Under variable costing,fixed manufacturing overhead cost is

Q186: The expendables in the flexible budget for

Q210: The January contribution format income statement of

Q269: The spending variance for laundry costs in