Pedroni Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools-Machining, Order Filling, and Other. The costs in those activity cost pools appear below:  Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

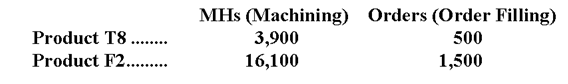

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:  Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.

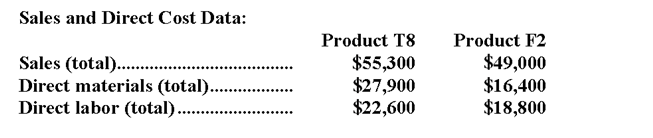

Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.

-The activity rate for the Order Filling activity cost pool under activity-based costing is closest to:

Definitions:

Resource Consumption

The process of using resources such as materials, energy, or time, typically quantified for analysis and optimization in various contexts.

Two-Way Analysis

A method used in statistics or research to examine the effect of two different variables on an outcome simultaneously.

Overhead Variances

Overhead Variances are differences between the actual overhead incurred and the standard or expected overhead, used to assess the efficiency of overhead cost control.

Fixed Budget Variance

The difference between the actual incurred expenses and the expenses budgeted for a set period, under the assumption of fixed operational conditions.

Q13: The manufacturing overhead that would be applied

Q30: The operating leverage is:<br>A)3<br>B)8<br>C)0.33<br>D)5

Q33: Tsui Clinic uses patient-visits as its measure

Q35: Pool Company's variable expenses are 36% of

Q76: The activity variance for selling and administrative

Q136: When production is less than sales for

Q145: Mish Clinic bases its budgets on patient-visits.During

Q149: A manufacturing company that produces a single

Q168: If the company sells 2,100 units,its total

Q197: Under absorption costing,for the month ended August