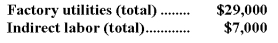

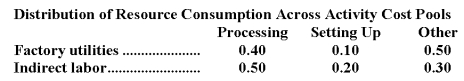

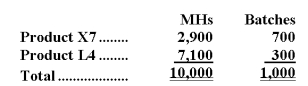

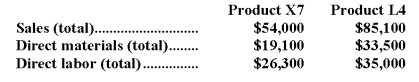

Murri Corporation has an activity-based costing system with three activity cost pools-Processing,Setting Up,and Other.The company's overhead costs,which consist of factory utilities and indirect labor,are allocated to the cost pools in proportion to the activity cost pools' consumption of resources.Costs in the Processing cost pool are assigned to products based on machine-hours (MHs)and costs in the Setting Up cost pool are assigned to products based on the number of batches.Costs in the Other cost pool are not assigned to products.Data concerning the two products and the company's costs and activity-based costing system appear below:

Required:

a.Assign overhead costs to activity cost pools using activity-based costing.

b.Calculate activity rates for each activity cost pool using activity-based costing.

c.Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

d.Determine the product margins for each product using activity-based costing.

Definitions:

Q9: What is the net operating income for

Q31: The salary of the treasurer of a

Q42: Bankert Corporation uses the step-down method to

Q52: Gaucher Corporation has provided the following data

Q58: The company's contribution margin ratio is closest

Q64: Dreyfus Memorial Diner is a charity supported

Q81: Which of the following represents the correct

Q112: The activity rate for Machining under activity-based

Q113: This question is to be considered independently

Q235: The net operating income in the flexible