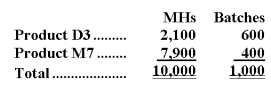

Irie Corporation has an activity-based costing system with three activity cost pools-Machining,Setting Up,and Other.The company's overhead costs have already been allocated to the cost pools and total $18,900 for the Machining cost pool,$20,500 for the Setting Up cost pool,and $23,600 for the Other cost pool.Costs in the Machining cost pool are assigned to products based on machine-hours (MHs)and costs in the Setting Up cost pool are assigned to products based on the number of batches.Costs in the Other cost pool are not assigned to products.Data concerning the two products appear below:  Required:

Required:

a.Calculate activity rates for each activity cost pool using activity-based costing.

b.Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

Definitions:

Visual

Relating to seeing or sight, often used in the context of learning, communication, or design.

Distractions

Distractions are anything that diverts an individual's attention away from their intended focus, potentially reducing productivity or quality of work.

Visuals

Graphic elements such as images, charts, and videos used to complement text or oral communication, enhancing understanding and retention.

Textual Information

Textual information refers to data that is presented in text form, as opposed to non-textual information like images, videos, or audio.

Q8: On a CVP graph for a profitable

Q9: What is the overhead cost assigned to

Q23: If two companies have the same total

Q49: Data for May concerning Dorow Corporation's two

Q81: The Spurling Cleaning Brigade Company provides housecleaning

Q98: The activity variance for net operating income

Q102: If the sales in Division L increase

Q112: Variable manufacturing overhead costs are treated as

Q131: During April,Division D of Carney Company had

Q151: In responsibility accounting,each segment in an organization