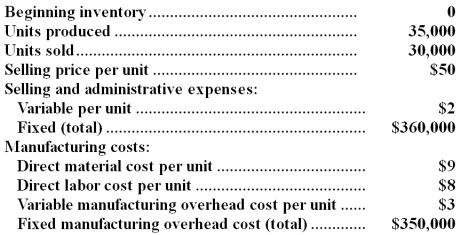

UHF Antennas,Inc. ,produces and sells a unique television antenna.The company has just opened a new plant to manufacture the antenna,and the following cost and revenue data have been reported for the first month of the new plant's operation:  Management is anxious to see how profitable the new antenna will be and has asked that an income statement be prepared for the month.Assume that direct labor is a variable cost.

Management is anxious to see how profitable the new antenna will be and has asked that an income statement be prepared for the month.Assume that direct labor is a variable cost.

Required:

a.Assuming that the company uses absorption costing,compute the unit product cost and prepare an income statement.

b.Assuming that the company uses variable costing,compute the unit product cost and prepare an income statement.

c.Explain the reason for any difference in the ending inventories under the two costing methods and the impact of this difference on reported net operating income.

Definitions:

Direct Political Control

The exercise of authority by a governing entity over the day-to-day governance and policy-making of a territory, without intermediary bodies.

Dependency Theorist

advocates for a model that views developing nations as being economically and politically dependent on more developed, industrialized nations, affecting their growth and development trajectory.

Multinational Corporations

Companies that operate in multiple countries, often with a centralized head office but with operational facilities and branches in different countries.

Authoritarian Governments

Forms of government in which a single entity or a small group possesses significant power, dictating policies and procedures without substantial public participation or opposition.

Q1: Glazener Corporation uses the FIFO method in

Q7: What would be the total overhead cost

Q12: The manufacturing overhead budget of Lewison Corporation

Q17: The total amount of Information Technology Department

Q44: This question is to be considered independently

Q96: Candice Corporation has decided to introduce a

Q105: If Eagle had sold only 9,000 tables

Q150: Gordy Corporation manufactures a variety of products.Last

Q156: Lone International Corporation's only product sells for

Q166: The contribution margin ratio for Product C