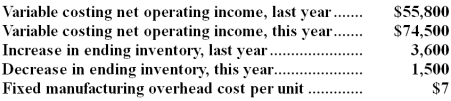

Carvey Corporation manufactures a variety of products.The following data pertain to the company's operations over the last two years:  Required:

Required:

a.Determine the absorption costing net operating income for last year.Show your work!

b.Determine the absorption costing net operating income for this year.Show your work!

Definitions:

Beneficiary

A person or entity entitled to receive benefits or funds under a will, insurance policy, retirement plan, or other contract.

Form W-4

A tax form completed by an employee to indicate his or her tax situation, such as exemptions and status, to the employer.

Dependents

Individuals, typically family members, who rely on another person, usually the primary earner, for financial support and are often covered by that person's health insurance policies.

Tax Purposes

Refer to the reasons or activities for which financial and transactional information is used to comply with taxation laws and regulations.

Q1: Mounts Corporation produces and sells two products.In

Q104: If the materials handling cost is allocated

Q109: Maga Company,which has only one product,has provided

Q112: The activity rate for Machining under activity-based

Q123: Under absorption costing,the unit product cost is:<br>A)$20<br>B)$18<br>C)$15<br>D)$25

Q125: The EG Company produces and sells one

Q136: Cosgrove Company manufactures two products,Product K-7 and

Q171: The contribution margin per unit during July

Q193: Suermann Corporation's only product sells for $140

Q239: On a CVP graph for a profitable