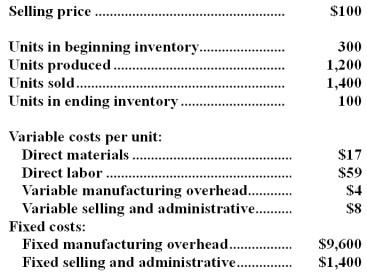

Leigh Company,which has only one product,has provided the following data concerning its most recent month of operations:  The company produces the same number of units every month,although the sales in units vary from month to month.The company's variable costs per unit and total fixed costs have been constant from month to month.

The company produces the same number of units every month,although the sales in units vary from month to month.The company's variable costs per unit and total fixed costs have been constant from month to month.

Required:

a.What is the unit product cost for the month under variable costing?

b.What is the unit product cost for the month under absorption costing?

c.Prepare a contribution format income statement for the month using variable costing.

d.Prepare an income statement for the month using absorption costing.

e.Reconcile the variable costing and absorption costing net operating incomes for the month.

Definitions:

Compounded Semi-annually

A method of calculating interest where the accumulated interest is added to the principal twice a year, impacting the overall interest earned.

Contribution

The act of giving something, often financial resources, to a common fund or cause.

Compounded Monthly

Refers to an interest calculation method where interest is added to the principal balance on a monthly basis, allowing the interest to earn interest.

Property Taxes

Taxes levied by local government on real property based on its value, used to fund public services.

Q11: In February,one of the processing departments at

Q23: How many units are in ending work

Q29: Both variable and fixed manufacturing overhead costs

Q33: The total Pediatrics Department cost after the

Q74: For the month referred to above,net operating

Q81: Hirt Corporation sells its product for $12

Q105: If Eagle had sold only 9,000 tables

Q107: Pressler Corporation's activity-based costing system has three

Q145: A manufacturing company that produces a single

Q146: In an income statement segmented by product