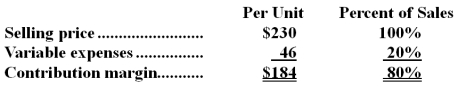

Data concerning Knipp Corporation's single product appear below:  Fixed expenses are $587,000 per month.The company is currently selling 4,000 units per month.The marketing manager would like to introduce sales commissions as an incentive for the sales staff.The marketing manager has proposed a commission of $16 per unit.In exchange,the sales staff would accept a decrease in their salaries of $57,000 per month.(This is the company's savings for the entire sales staff. ) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 100 units.What should be the overall effect on the company's monthly net operating income of this change?

Fixed expenses are $587,000 per month.The company is currently selling 4,000 units per month.The marketing manager would like to introduce sales commissions as an incentive for the sales staff.The marketing manager has proposed a commission of $16 per unit.In exchange,the sales staff would accept a decrease in their salaries of $57,000 per month.(This is the company's savings for the entire sales staff. ) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 100 units.What should be the overall effect on the company's monthly net operating income of this change?

Definitions:

Acquisition Differential

The disparity between what was paid to acquire a company and the fair market value of its recognizable net assets.

Equity Method

An accounting technique used by a company to record its investment in another company when it has significant influence over that company but does not have full control.

Bonds Payable

Long-term liabilities representing borrowed funds which the company is obligated to repay to bondholders at a specified future date.

Bond Discount

The difference between the face value of a bond and the price for which it is sold, when the bond is issued at less than its face value.

Q6: The overhead cost per unit of Product

Q45: If the budgeted direct labor time for

Q50: Under the FIFO method,costs per equivalent unit

Q77: What are the equivalent units for conversion

Q97: What are the equivalent units for materials

Q114: Which of the following are considered to

Q152: Loren Company's single product has a selling

Q155: The amount by which a company's sales

Q165: East Company manufactures and sells a single

Q195: The annual sales volume required for Madengrad