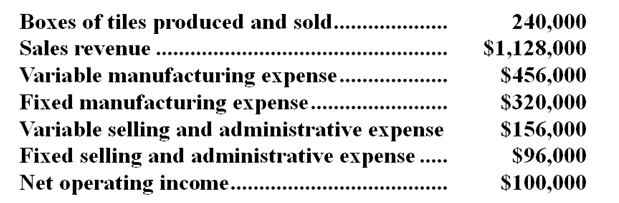

A tile manufacturer has supplied the following data:

-What is the company's unit contribution margin?

Definitions:

Maximum Deduction

The highest amount that can be subtracted from taxable income, as allowed by tax laws.

Cost Recovery Deduction

A tax deduction that allows a taxpayer to recover the cost of an investment over time through depreciation, amortization, or depletion.

50% Bonus

A premium payment of half the worth of an item, salary, or stipulated amount as an additional reward.

Cost Recovery Deduction

A deduction that allows a taxpayer to recover the cost of an investment over time, such as through depreciation or amortization.

Q14: Salonia Corporation manufactures a variety of products.The

Q23: Under absorption costing,the ending inventory for the

Q46: Assuming that Uinta allocates service department costs

Q89: Retained earnings at the end of December

Q99: When computing the cost per equivalent unit,it

Q109: Job 731 was recently completed.The following data

Q167: The variable expense per unit is:<br>A)$10.00 per

Q169: The following information pertains to Clove Co.:

Q193: Under variable costing,the unit product cost is:<br>A)$20<br>B)$18<br>C)$15<br>D)$22

Q238: A 10% increase in fixed expense would