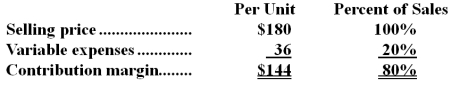

Data concerning Tietz Corporation's single product appear below:  Fixed expenses are $1,044,000 per month.The company is currently selling 9,000 units per month.

Fixed expenses are $1,044,000 per month.The company is currently selling 9,000 units per month.

Required:

The marketing manager would like to introduce sales commissions as an incentive for the sales staff.The marketing manager has proposed a commission of $14 per unit.In exchange,the sales staff would accept an overall decrease in their salaries of $110,000 per month.The marketing manager predicts that introducing this sales incentive would increase monthly sales by 400 units.What should be the overall effect on the company's monthly net operating income of this change? Show your work!

Definitions:

Financial Accounting

The branch of accounting that involves the process of recording, summarizing, and reporting the myriad of transactions resulting from business operations over a period of time.

Managerial Accounting

The practice of analyzing, interpreting, and presenting financial information for internal management use in planning, decision-making, and operational control.

Management

The process of dealing with or controlling things or people, often within the context of a business or organization.

Proprietorships

Business entities owned by a single individual, who has full control over operations and takes on the liabilities of the business personally.

Q12: The following data have been provided by

Q13: The break-even sales in dollars is (round

Q31: Assume Grand uses the step-down allocation method

Q46: Assuming that Uinta allocates service department costs

Q46: The total amount of overhead cost

Q74: This question is to be considered independently

Q82: A proposal has been made that will

Q99: When computing the cost per equivalent unit,it

Q142: The manufacturing overhead was:<br>A)$2,200 underapplied<br>B)$2,200 overapplied<br>C)$400 overapplied<br>D)$400

Q166: Zeeb Corporation produces and sells a single