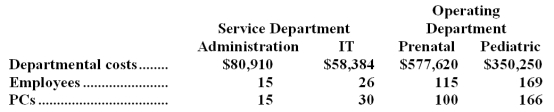

Stazenski Children's Clinic allocates service department costs to operating departments using the step-down method.The clinic has two service departments,Administration and Information Technology (IT) ,and two operating departments,Prenatal and Pediatric.Data concerning those departments follow:  Administration costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs.The total Pediatric Department cost after allocations is closest to:

Administration costs are allocated first on the basis of employees and IT costs are allocated second on the basis of PCs.The total Pediatric Department cost after allocations is closest to:

Definitions:

PST

Depending on the context, this could stand for Pacific Standard Time, which is the time zone observed on the west coast of the United States, or Provincial Sales Tax, a tax imposed by some Canadian provinces.

GST

Goods and Services Tax; a value-added tax levied on most goods and services sold for domestic consumption.

Mill Rate

A property tax rate expressed in tenths of a cent, applying to the assessed value of property.

Property Taxes

Taxes paid by property owners, typically annually, based on the assessed value of their property and the tax rate of the local government.

Q2: A company has provided the following data:

Q5: The cost per equivalent unit for conversion

Q7: What are the equivalent units for conversion

Q13: What are the equivalent units for conversion

Q16: Rider Company sells a single product.The product

Q101: The break-even point in units for the

Q103: Fellner Corporation produces a single product and

Q125: The EG Company produces and sells one

Q131: During April,Division D of Carney Company had

Q202: The company's break-even in bundles is closest