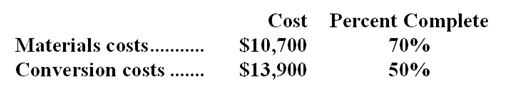

Atwich Corporation uses the weighted-average method in its process costing system. This month, the beginning inventory in the first processing department consisted of 600 units. The costs and percentage completion of these units in beginning inventory were:  A total of 5,100 units were started and 4,400 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month:

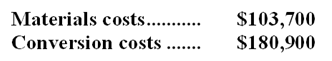

A total of 5,100 units were started and 4,400 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month:  The ending inventory was 75% complete with respect to materials and 10% complete with respect to conversion costs.

The ending inventory was 75% complete with respect to materials and 10% complete with respect to conversion costs.

Note: Your answers may differ from those offered below due to rounding error. In all cases, select the answer that is the closest to the answer you computed. To reduce rounding error, carry out all computations to at least three decimal places.

-The cost of ending work in process inventory in the first processing department according to the company's cost system is closest to:

Definitions:

Simple Linear Regression

A statistical method that models the relationship between a dependent variable and one independent variable by fitting a linear equation to the observed data.

Response Variable

The variable in a study or experiment that is assumed to depend on or be affected by changes in another variable (often called the independent variable).

Explanatory Variable

A variable in a statistical model that is believed to cause or explain changes in the response variable.

SST

Total sum of squares; a term used in statistics to describe the total variance in a dataset.

Q28: What are the equivalent units for conversion

Q34: Moncrief Inc.produces and sells a single product.The

Q51: Assurer Inc.uses the weighted-average method in its

Q54: Balonek Inc.'s contribution margin ratio is 57%

Q68: The total cost transferred from the first

Q76: Fayard Corporation uses the weighted-average method in

Q78: Flitter Corporation uses the weighted-average method in

Q92: The margin of safety percentage is

Q105: What is the best estimate of the

Q109: Given the cost formula Y = $15,000