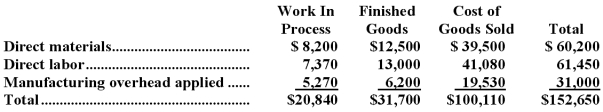

Graeser Inc.has provided the following data for the month of May.There were no beginning inventories;consequently,the direct materials,direct labor,and manufacturing overhead applied listed below are all for the current month.  Manufacturing overhead for the month was overapplied by $4,000.

Manufacturing overhead for the month was overapplied by $4,000.

The company allocates any underapplied or overapplied manufacturing overhead among work in process,finished goods,and cost of goods sold at the end of the month on the basis of the overhead applied during the month in those accounts.

The journal entry to record the allocation of any underapplied or overapplied manufacturing overhead for May would include the following:

Definitions:

Pre-merger WACC

The Weighted Average Cost of Capital for a company before undergoing a merger, representing its cost of funds.

Capital Structure

Capital structure refers to the composition of a company's funding obtained through debt and equity, including bonds, loans, and stock.

Synergy

The concept that the combined value and performance of two companies will be greater than the sum of the separate individual parts.

Equity-financed

Equity-financed refers to funding a business or project through selling ownership interests (shares) in the company rather than borrowing through debt.

Q1: T5-2B OPERATIVE REPORT, ULCER EXCISION AND

Q3: T6-2B RADIOLOGY REPORT, CHEST<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6048/.jpg" alt="T6-2B

Q8: Lachapelle Corporation would like to determine the

Q20: The cost per equivalent unit for conversion

Q33: Haras Corporation is a wholesaler that sells

Q64: The break-even point for Southwest Industries in

Q82: In the department's cost reconciliation report for

Q84: The Assembly Department started the month with

Q98: In March,one of the processing departments at

Q104: Guitian Corporation produces and sells a single