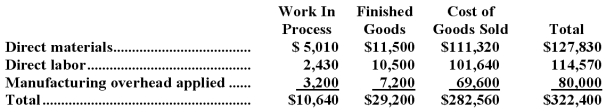

Caryl Inc.has provided the following data for the month of March.There were no beginning inventories;consequently,the direct materials,direct labor,and manufacturing overhead applied listed below are all for the current month.  Manufacturing overhead for the month was underapplied by $10,000.

Manufacturing overhead for the month was underapplied by $10,000.

The company allocates any underapplied or overapplied manufacturing overhead among work in process,finished goods,and cost of goods sold at the end of the month on the basis of the overhead applied during the month in those accounts.

The journal entry to record the allocation of any underapplied or overapplied manufacturing overhead for March would include the following:

Definitions:

Discount Rate

The interest rate used to discount future cash flows to their present values, reflecting the time value of money and risk.

Acquisition

The process by which one company takes over another and clearly establishes itself as the new owner.

Free Cash Flow

Cash generated by a business above that needed for asset replacement and growth.

Leveraged Buyout

The process of purchasing another firm primarily through the use of a substantial amount of debt financing, such as bonds or loans, to cover the acquisition expenses.

Q6: T5-1B OPERATIVE REPORT, EXCISIONAL BIOPSY<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6048/.jpg"

Q7: A direct labor worker at Damann Corporation

Q24: Wert Corporation uses a predetermined overhead rate

Q31: What would be the total prevention cost

Q39: Gadola Company's quality cost report is to

Q61: During August,Allee Corporation incurred $64,000 of actual

Q69: The prime cost for April was:<br>A)$59,000<br>B)$122,000<br>C)$100,000<br>D)$111,000

Q71: Lyster Inc.has provided the following data for

Q76: The cost per equivalent unit for materials

Q199: Penury Company offers two products.At present,the following