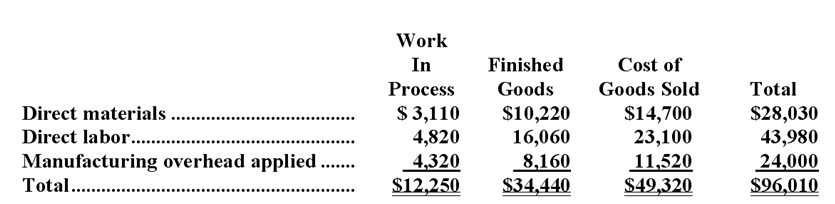

Joens Inc. has provided the following data for the month of July. There were no beginning inventories; consequently, the direct materials, direct labor, and manufacturing overhead applied listed below are all for the current month.  Manufacturing overhead for the month was overapplied by $2,000.

Manufacturing overhead for the month was overapplied by $2,000.

The company allocates any underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold at the end of the month on the basis of the overhead applied during the month in those accounts.

-The journal entry to record the allocation of any underapplied or overapplied manufacturing overhead for July would include the following:

Definitions:

Predictable Dividend Payout

Regular, forecastable payments made by a company to its shareholders, usually as a part of the firm's profit sharing mechanism.

Clientele Effect

The theory that a company’s stock price will move according to the demands and preferences of its investors or clientele regarding dividend policies.

Tax-Exempt Institutional

Refers to entities or investment products that do not have to pay federal or state income taxes.

Low Dividend Policy

A corporate practice of distributing minimal portions of the company's earnings to its shareholders as dividends.

Q2: AUDIT REPORT T10.1 OPERATIVE REPORT, RESECTION<br> <img

Q9: If the company bases its predetermined overhead

Q29: In a process costing system,manufacturing overhead applied

Q33: Which of the following would be classified

Q33: Haras Corporation is a wholesaler that sells

Q36: The total Fabrication Department cost after service

Q44: Sobczynski Corporation uses the step-down method to

Q64: The cost of goods sold for September

Q154: Schlag Inc.expects its sales in January to

Q161: Bidwell's break-even sales in units is:<br>A)30,000 units<br>B)91,000