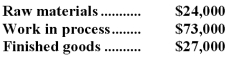

Alam Company is a manufacturing firm that uses job-order costing.At the beginning of the year,the company's inventory balances were as follows:  The company applies overhead to jobs using a predetermined overhead rate based on machine-hours.At the beginning of the year,the company estimated that it would work 45,000 machine-hours and incur $180,000 in manufacturing overhead cost.The following transactions were recorded for the year:

The company applies overhead to jobs using a predetermined overhead rate based on machine-hours.At the beginning of the year,the company estimated that it would work 45,000 machine-hours and incur $180,000 in manufacturing overhead cost.The following transactions were recorded for the year:

a.Raw materials were purchased,$416,000.

b.Raw materials were requisitioned for use in production,$420,000 ($380,000 direct and $40,000 indirect).

c.The following employee costs were incurred: direct labor,$414,000;indirect labor,$60,000;and administrative salaries,$212,000.

d.Selling costs,$141,000.

e.Factory utility costs,$20,000.

f.Depreciation for the year was $81,000 of which $73,000 is related to factory operations and $8,000 is related to selling,general,and administrative activities.

g.Manufacturing overhead was applied to jobs.The actual level of activity for the year was 48,000 machine-hours.

h.The cost of goods manufactured for the year was $1,004,000.

i.Sales for the year totaled $1,416,000 and the costs on the job cost sheets of the goods that were sold totaled $989,000.

j.The balance in the Manufacturing Overhead account was closed out to Cost of Goods Sold.

Required:

Prepare the appropriate journal entry for each of the items above (a.through j. ).You can assume that all transactions with employees,customers,and suppliers were conducted in cash.

Definitions:

Variances

The differences between expected and actual figures in budgeting and accounting, which can indicate over or under performance.

Materials Price Variance

The difference between the actual cost of materials used in production and the expected cost under standard costing.

Raw Materials

Basic materials that are used in the production process of manufacturing goods, which are then converted into finished products.

Standard Cost

A predetermined cost of manufacturing, labor, and material as estimated in accordance with standards set by the company.

Q3: The management of Svatek Corporation would like

Q14: The constrained resource at Calabria Corporation is

Q20: To the nearest whole cent,what should be

Q28: Using the high-low method,the estimate of the

Q29: The total of the product costs listed

Q60: Crinks Corporation uses direct labor-hours in its

Q62: How many units of product A19D should

Q92: The cost per equivalent unit for conversion

Q111: This question is to be considered independently

Q156: When a decision is made among a