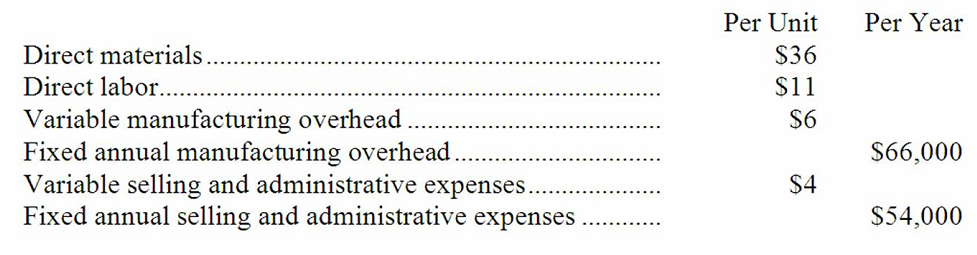

The management of Store Corporation would like to set the selling price on a new product using the absorption costing approach to cost-plus pricing. The company's accounting department has supplied the following estimates for the new product:  Management plans to produce and sell 6,000 units of the new product annually. The new product would require an investment of $1,140,000 and has a required return on investment of 10%.

Management plans to produce and sell 6,000 units of the new product annually. The new product would require an investment of $1,140,000 and has a required return on investment of 10%.

-The unit target selling price using the absorption costing approach is closest to:

Definitions:

Fair Value

The cost at which an asset could be sold or a liability could be resolved in a structured exchange among participants in the market as of the evaluation date.

Common Shares

are equity securities that represent ownership in a corporation, entitling holders to a share of the corporation's profits through dividends and/or capital appreciation.

Consolidated Financial Statements

Financial statements that show the financial position and results of operations for a parent company and its subsidiaries as one economic entity.

Current Assets

Assets that are expected to be converted into cash, sold, or consumed within one year or within a business's normal operating cycle if longer.

Q2: AUDIT REPORT T10.1 OPERATIVE REPORT, RESECTION<br> <img

Q2: T3-2A CT SCAN, SINUSES<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6048/.jpg" alt="T3-2A

Q6: T5-1B OPERATIVE REPORT, EXCISIONAL BIOPSY<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6048/.jpg"

Q10: The net cash provided by (used in)investing

Q13: According to the formula in the text,what

Q21: The following data pertains to activity and

Q32: Charging clients based on the value-based pricing

Q39: Although the contribution format income statement is

Q47: Rizer Corporation manufactures a product that has

Q53: When long-term investment funds are the constraint