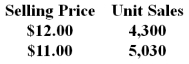

Inkeo Company recently changed the selling price of one of its products.Data concerning sales for comparable periods before and after the price change are presented below.  The product's variable cost is $12.70 per unit. According to the formula in the text,the product's profit-maximizing price is closest to:

The product's variable cost is $12.70 per unit. According to the formula in the text,the product's profit-maximizing price is closest to:

Definitions:

LIFO

LIFO stands for "Last In, First Out," a method used in inventory management and accounting where the most recently produced items are recorded as sold first.

Income Tax Expense

The cost associated with income taxes due to a government, calculated based on taxable income.

Cash Flows

The total amount of money being transferred into and out of a business, particularly in relation to its operating, investing, and financing activities.

Net Income

The ultimate profit of a firm calculated by subtracting all outgoings and taxation from the gross revenue.

Q1: The constraint at Mirsch Inc.is a

Q7: AUDIT REPORT T6.2 ANGIOPLASTY/STENT<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6048/.jpg" alt="AUDIT

Q10: The work in process inventory at the

Q15: A catering service has contracts with a

Q27: Hamelinck Corporation would like to determine the

Q39: From the standpoint of the entire company,if

Q55: The absolute profitability of a segment is

Q75: The work in process inventory at the

Q81: In a job-order costing system,direct labor cost

Q122: Each of the following would be a