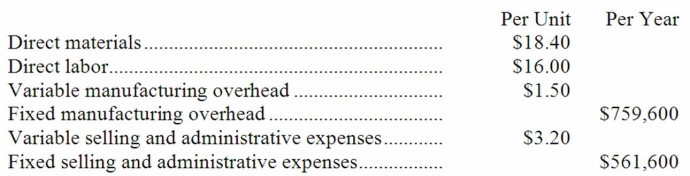

Qudsi Company makes a product that has the following costs:

The company uses the absorption costing approach to cost-plus pricing as described in the text.The pricing calculations are based on budgeted production and sales of 36,000 units per year.

The company has invested $580,000 in this product and expects a return on investment of 12%.

Required:

a.Compute the markup on absorption cost.

b.Compute the selling price of the product using the absorption costing approach.

c.Assume that every 10% increase in price leads to a 13% decrease in quantity sold.Assuming no change in cost structure and that direct labor is a variable cost,compute the profit-maximizing price.

Definitions:

Identify Your Desired Impact

The process of defining the specific outcomes or changes you wish to achieve with your actions or project.

Nonprofit Manager

An individual responsible for overseeing and managing the operations, staff, and resources of a nonprofit organization, ensuring alignment with its mission and goals.

Intervention

Intervention refers to the act of becoming involved in a situation to change the outcome or influence the process, often aimed at improving conditions or behaviors.

Burnout

A state of physical, emotional, and mental exhaustion caused by prolonged stress, often due to overwork.

Q16: The best estimate of the total variable

Q27: What would be the total external failure

Q28: Gayman Corporation applies manufacturing overhead to products

Q32: Which of the following would be classified

Q40: Comparative statement of financial position and the

Q46: Minturn Inc.has provided the following data for

Q57: The markup on absorption cost for this

Q117: The Work in Process inventory account of

Q123: The best estimate of the total variable

Q153: Escatel Corporation bases its predetermined overhead rate