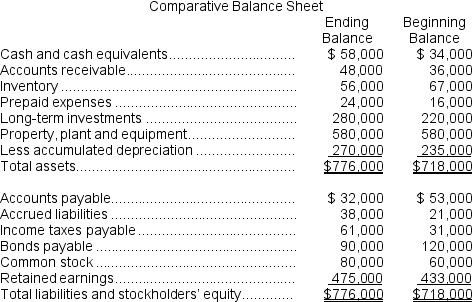

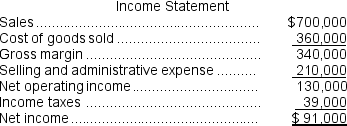

(Appendix 14A) Van Beeber Corporation's comparative balance sheet and income statement for last year appear below:

The company declared and paid $49,000 in cash dividends during the year. It did not sell or retire any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by (used in) operating activities.

The company declared and paid $49,000 in cash dividends during the year. It did not sell or retire any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by (used in) operating activities.

-On the statement of cash flows,the income tax expense adjusted to a cash basis would be:

Definitions:

Autonomous Consumption

Consumer spending that does not depend on current income, influenced instead by factors like wealth and basic needs.

Autonomous Consumption

The level of consumption that occurs when income is zero, representing the expenditures needed to meet basic needs.

Disposable Income

The available sum for households to allocate on spending and saving post the deduction of income taxes.

Consumption

The use of goods and services by households, including both durable and non-durable goods.

Q12: Suppose that Division A is operating at

Q19: If the company bases its predetermined overhead

Q20: What would be the total appraisal cost

Q29: The absorption costing unit product cost is:<br>A)$57<br>B)$64<br>C)$77<br>D)$53

Q34: The amount of fixed manufacturing overhead cost

Q44: Lasswell Corporation uses the FIFO method

Q62: Joeston Corporation makes a product with

Q64: If the denominator level of activity is

Q128: The gross margin for June was:<br>A)$310,200<br>B)$1,234,200<br>C)$396,000<br>D)$519,200

Q134: In October,Patnode Inc. ,a merchandising company,had sales