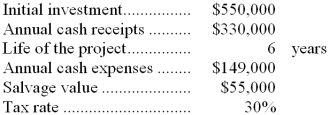

Wable Inc. has provided the following data to be used in evaluating a proposed investment project:  For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 16%.

For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 16%.

-When computing the net present value of the project, what is the annual amount of the depreciation tax shield? In other words, by how much does the depreciation deduction reduce taxes each year in which the depreciation deduction is taken?

Definitions:

Relationship Contexts

The situational backgrounds or environments that define the nature of interactions between individuals or groups.

Relationship

A connection, association, or involvement between two or more parties, often characterized by emotional or social ties.

Calculus-Based Trust

Trust that is based on the rational calculation that another will act predictably or as expected based on incentives and deterrents.

Trust In Negotiations

Trust in negotiations is the confidence that parties have in each other's commitment to abide by agreements, act ethically, and not exploit any vulnerabilities.

Q2: What is the predetermined overhead rate to

Q3: On the statement of cash flows,the selling

Q6: T7-2C PATHOLOGY REPORT<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6048/.jpg" alt="

Q10: Bustle Manufacturing Corporation has a traditional

Q14: (Ignore income taxes in this problem. )Knipper

Q16: Idle time for direct labor factory workers

Q17: The product's price elasticity of demand as

Q28: Minaya Corporation has two products,M20 and

Q61: The target cost per unit is closest

Q63: Holding all other things constant,an increase in