Addy Company makes two products: Product A and Product B. Annual production and sales are 1,700 units of Product A and 1,100 units of Product B. The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.3 direct labor-hours per unit and Product B requires 0.6 direct labor-hours per unit. The total estimated overhead for next period is $98,785.

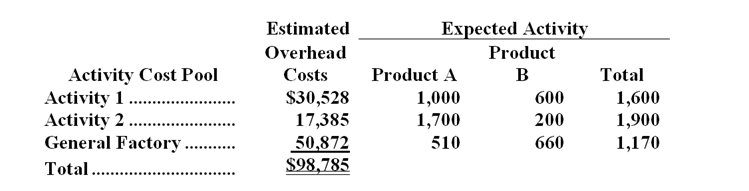

The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools--Activity 1, Activity 2, and General Factory--with estimated overhead costs and expected activity as follows: (Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

-The predetermined overhead rate (i.e. ,activity rate) for Activity 2 under the activity-based costing system is closest to:

Definitions:

Succession Problem

The issue of who will run a business when the current head leaves.

Leadership

The act of guiding, directing, or influencing followers and orchestrating strategies to achieve a common goal.

Family Business

A business owned and controlled by members of a family.

Succession Plan

A plan for how a firm’s leadership transition and related financial matters will be handled.

Q4: Phoenix Company makes custom covers for

Q5: Significant professional judgment is never required to

Q6: Control risk is:<br>A) the susceptibility of an

Q15: The selling and administrative expense adjusted to

Q36: What was Wriphoff's fixed manufacturing overhead budget

Q49: Which of the following are included in

Q51: Subsequent events procedures are normally performed through

Q58: Existence of trade receivables is usually verified

Q61: The budget variance for August is:<br>A)$6,960 F<br>B)$2,240

Q64: How many units of product E25Y should