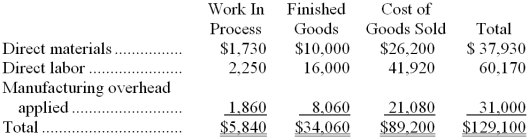

Jupiter Inc. has provided the following data for the month of August. There were no beginning inventories; consequently, the direct materials, direct labor, and manufacturing overhead applied listed below are all for the current month.  Manufacturing overhead for the month was underapplied by $2,000.

Manufacturing overhead for the month was underapplied by $2,000.

The company allocates any underapplied or overapplied overhead among work in process, finished goods, and cost of goods sold at the end of the month on the basis of the overhead applied during the month in those accounts.

-The journal entry to record the allocation of any underapplied or overapplied overhead for August would include the following:

Definitions:

Shares

Units of ownership interest in a corporation or financial asset that provide for an equal distribution in any profits, if any are declared, in the form of dividends.

Post-Acquisition Equity

The change in the investor’s share of the net assets of an investee after the acquisition date.

Pre-Acquisition Equity

Refers to the amount of equity held in a company before it is acquired by another entity, often considered in the evaluation of acquisition deals and the consolidation of financial statements.

Q7: The Labor Efficiency Variance for June would

Q12: When analyzing a mixed cost,you should always

Q12: If the denominator activity (in hours)used to

Q13: Bob works 48 hours in a given

Q20: Enquiry involves the auditor<br>A) using questioning skills

Q47: Most of the opportunities to reduce the

Q53: Milushka Icaza, who was representing her CPA

Q56: A new product,an automated crepe maker,is being

Q63: One cause of an unfavorable overhead volume

Q74: From the standpoint of the entire company,if