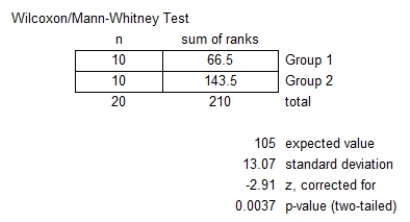

Refer to the MegaStat/Excel output for the Wilcoxon rank sum test given in the table below.  At a significance level of .05,which one of the following statements is correct regarding the following null hypothesis? H0: D1 and D2 are identical probability distributions.

At a significance level of .05,which one of the following statements is correct regarding the following null hypothesis? H0: D1 and D2 are identical probability distributions.

Definitions:

Income Tax Withholding

The practice of deducting income tax from an employee's gross pay on behalf of the government, reducing the amount the employee takes home.

Multiple Support Agreement

An agreement where multiple parties contribute to the support of an individual, allowing one to claim a tax exemption under certain conditions.

Claim the Mother

The act of declaring a mother as a dependent or beneficiary for tax or legal purposes, subject to specific criteria.

Special Test for Qualifying Child

Criteria established by tax authorities to determine if a child is eligible for tax benefits, focusing on relationship, age, residency, and support.

Q11: The Wilcoxon rank sum test requires that

Q21: When using a chi-square goodness-of-fit test with

Q38: The _ component of a time series

Q40: In a multiple regression analysis,if the normal

Q43: When we carry out a chi-square test

Q62: In a contingency table,when all the expected

Q76: A univariate time-series model is used to

Q91: In the quadratic regression model y =

Q109: Given the following data,compute the mean absolute

Q110: Consider the following partial computer output from