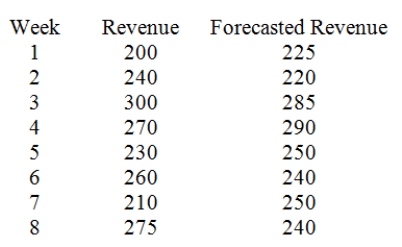

Given the following data,compute the mean squared error (deviation).

Definitions:

Two-factor Model

A financial model that considers two sources of risk in its valuation or pricing, typically used in evaluating or predicting financial returns.

Market Risk

The risk of losses due to factors that affect an entire market or asset class, also known as systematic risk, which cannot be eliminated through diversification.

Interest Rate Risk

The potential for investment losses resulting from changes in interest rates.

Capital Asset Pricing Model

A model that describes the relationship between systematic risk and expected return for assets, particularly stocks; it is used to determine a theoretically appropriate required rate of return of an asset.

Q7: Consider the following set of quarterly sales

Q9: Refer to the MegaStat/Excel output for the

Q18: The multiplicative Winters' method used to forecast

Q26: A unit that fails to meet specifications

Q42: A set of potential future conditions that

Q51: In a decision-making situation,the maximum amount of

Q56: Let p<sub>1</sub> represent the population proportion of

Q63: Using the p-value rule for a population

Q83: When the quadratic regression model y =

Q127: If the Durbin-Watson statistic is less than