Use this information for questions that refer to the United Tools case.

Terry Harter is marketing manager for United Tools and Mike O'Reilly is the firm's logistics manager. They work together to make decisions about how to get United's hand and power tools to its customers - a mix of manufacturing plants and final consumers (who buy United tools at a hardware store) . United Tools does not own its own transport facilities and it works with wholesalers to reach its business customers.

Together, Harter and O'Reilly try to coordinate transporting, storing, and product handling activities to minimize cost while still achieving the customer service level their customers and intermediaries want. This usually requires that United keep an inventory of most of its products on hand, but demand for its products is fairly consistent over time so inventory is easy to manage.

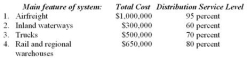

Harter has identified four options for physical distribution systems she could use to reach two of her key wholesalers, Ralston Supply and Ricotta Tool Co. The total cost for each option--and the distribution service levels that can be achieved--are as follows:  Ralston Supply expects a very high level (90 percent) of distribution customer service. Ricotta Tool Co. is willing to settle for a 70 percent customer service level, even if that means some products will occasionally be out of stock, if it gets products at a lower price.

Ralston Supply expects a very high level (90 percent) of distribution customer service. Ricotta Tool Co. is willing to settle for a 70 percent customer service level, even if that means some products will occasionally be out of stock, if it gets products at a lower price.

For its large retail hardware customers (like Home Depot) , United regularly ships smaller orders directly to individual stores or in some cases to the retail chain's warehouses. Cross-country shipments usually go by rail while regional shipments usually go by truck.

-As marketing manager, United's Terry Harter should realize that:

Definitions:

Asset Account

An account on a company’s balance sheet that represents a resource controlled by the company as a result of past events and from which future economic benefits are expected.

Liability Account

An accounting record of amounts owed by a business to creditors, typically categorized as current or long-term liabilities.

Bank Service Charge

Fees charged by banks for handling specific types of transactions, account maintenance, or services rendered.

Note Receivable

A written promise that requires one party to pay a specified sum of money to another party on a set date or on demand.

Q29: Direct-to-customer channels are rarely used in business

Q38: To help in managing excess inventory, United

Q53: Cooperative chains:<br>A) are sponsored by wholesalers to

Q87: Which of the following is NOT a

Q112: Which of the following statements about limited-function

Q128: When planning new products, managers need not

Q190: Which of the following is NOT one

Q199: A manufacturer that uses several competing channels

Q223: Vertical marketing systems account for a majority

Q239: During the MARKET INTRODUCTION stage of the