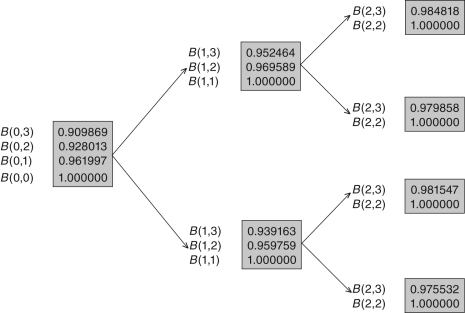

Use the fact that the pseudo-probability of default at time zero is (1 / 2) to answer the questions that follow.

-Consider a caplet with maturity time 1 and strike price 0.035.What are the payoffs to the option at time 1 in the up and down nodes?

Definitions:

Free Floating Exchange Rate System

A currency system where the value of a country's currency is determined by the supply and demand for the currency in the foreign exchange market, without direct government control.

Trade Deficit

A situation where a country's imports of goods and services exceed its exports, leading to more money flowing out of the country than coming in.

Billion

A numerical value equal to 1,000 million in the short scale and 1,000,000 million in the long scale.

Depreciates In Value

The process by which an asset loses value over time.

Q6: The arbitrage profit that you can make

Q8: Which of the following statements is INCORRECT?<br>A)

Q11: Which statement about the argument underlying the

Q16: Identify the INCORRECT statement.The HJM libor model's

Q18: Mexican cession<br>A)Lands taken by the United States

Q26: Public choice theory assumes that each voter

Q58: How did African slaves create a homogeneous

Q68: Which of the following was an evangelical

Q77: What were the main economic policies the

Q80: The second Confiscation Act,passed in July 1862,declared