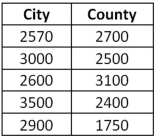

Exhibit 20.5.An accountant wants to know if the property taxes paid by clients that live in the city are different from those that live in the county.The property taxes paid by five clients from the city (1) and five clients from the county (2) are shown below (in dollars) .  Refer to Exhibit 20.5.Using the critical value approach,the appropriate conclusion is:

Refer to Exhibit 20.5.Using the critical value approach,the appropriate conclusion is:

Definitions:

Fixed-Ratio

A schedule of reinforcement where a response is reinforced only after a specified number of responses, leading to a high and steady rate of response.

Fixed-Interval

A schedule of reinforcement where the first response is rewarded only after a specified amount of time has elapsed, leading to a pattern of responses.

Primary

In psychology, often refers to primary reinforcers or stimuli, which are innately satisfying or desirable without learning.

Secondary

In psychology, refers to stimuli or reinforcers that acquire their effectiveness through association with primary reinforcers.

Q2: In the United States,only this group has

Q5: Class refers to a large category of

Q7: Exhibit 20.5.An accountant wants to know if

Q7: Christopher Columbus's initial contact with Native Americans

Q17: The tendency for people to describe themselves

Q18: In the time series decomposition method,to obtain

Q21: Individuals who score higher on functional literacy

Q30: The field of sociology began to change

Q32: The "underclass" is characterized by<br>A)high rates of

Q47: Exhibit 20.8.A sports agent wants to understand