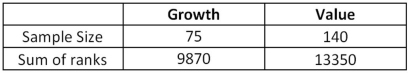

Exhibit 20.6.A fund manager wants to know if the annual rate of return is greater for growth stocks (1) than value stocks (2) .The fund manager collects data on the returns of growth and value funds.Below are the sample sizes and rank sums for the Wilcoxon rank-sum test.  Refer to Exhibit 20.6.Using the critical value approach,the appropriate conclusion is:

Refer to Exhibit 20.6.Using the critical value approach,the appropriate conclusion is:

Definitions:

APB No.25

An accounting principle that dealt with stock-based compensation and required companies to record an expense for issued options.

Vesting Period

The period of time an employee must work before gaining full access to their benefits or compensation plans, such as pension plans or stock options.

Stock Options

Financial instruments that give employees the right to buy or sell shares of their company at a predetermined price.

Grant Period

The time frame during which certain rights, such as stock options, are awarded to employees and can be exercised.

Q2: During the 1950s,the leading voice in sociology

Q4: Exhibit 20.1.A pawn shop claims to sell

Q6: Exhibit 18.8.Quarterly sales of a department store

Q11: The informal job sector includes<br>A)unlicensed childcare<br>B)prostitution<br>C)street vending<br>D)all

Q12: Describe the cultural capital benefits of an

Q14: How do prestigious colleges and universities and

Q16: Exhibit 16-1.The following Excel scatterplot with the

Q18: Which of the following statements is true

Q33: In forecasting methods,the mean square error (MSE)is

Q56: A polynomial trend model that only allows