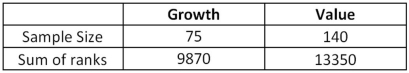

Exhibit 20.6.A fund manager wants to know if the annual rate of return is greater for growth stocks (1) than value stocks (2) .The fund manager collects data on the returns of growth and value funds.Below are the sample sizes and rank sums for the Wilcoxon rank-sum test.  Refer to Exhibit 20.6.Using the p-value approach and

Refer to Exhibit 20.6.Using the p-value approach and  ,the appropriate conclusion is:

,the appropriate conclusion is:

Definitions:

Conventional CAPM

The Capital Asset Pricing Model, a financial model that describes the relationship between systematic risk and expected return for assets, typically used for pricing risky securities.

Human Capital

The economic value of an individual's skill set and knowledge, which can contribute to their productivity and earnings.

Conditional CAPM

An extension of the Capital Asset Pricing Model that accounts for varying conditions over time or different market environments.

Empirical Returns

Returns that are calculated based on historical data, reflecting the actual gains or losses realized over a specific period.

Q2: An American ideology that supports U.S.society's social

Q3: Putting professional management in charge of corporations

Q5: Rates of return expressed in nominal terms

Q10: Middle-class black women lawyers often attended black

Q11: Explain how the media represents different racial

Q13: What are some of the strategies used

Q22: Television commercials have shown<br>A)women in less stereotypical

Q30: An apprentice is one who<br>A)learns from his

Q42: The regression model ln(y)= β<sub>0</sub> + β<sub>1</sub>x

Q67: Exhibit 17.8.A realtor wants to predict and