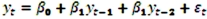

Exhibit 18.7.The following table shows the annual revenues (in millions of dollars)of a pharmaceutical company over the period 1990-2011.  The autoregressive models of order 1 and 2,

The autoregressive models of order 1 and 2,  and

and  ,were applied on the time series to make revenue forecasts.The relevant parts of Excel regression outputs are given below.

,were applied on the time series to make revenue forecasts.The relevant parts of Excel regression outputs are given below.

Model AR(1):  Model AR(2):

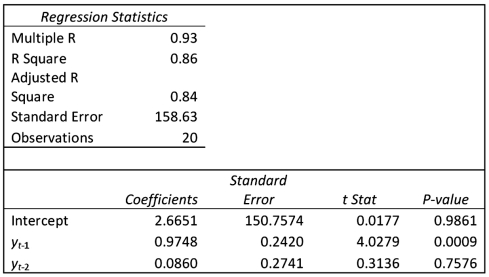

Model AR(2):  Refer to Exhibit 18.7.When for AR(1),H0: β0 = 0 is tested against HA: β0 ≠ 0,the p-value of this t test shown by Excel output is 0.9590.This could suggest that the model

Refer to Exhibit 18.7.When for AR(1),H0: β0 = 0 is tested against HA: β0 ≠ 0,the p-value of this t test shown by Excel output is 0.9590.This could suggest that the model  .might be an alternative to the AR(1)model

.might be an alternative to the AR(1)model  .Excel partial output for this simplified model is:

.Excel partial output for this simplified model is:  Find the revenue forecast for 2012 through the use of

Find the revenue forecast for 2012 through the use of  .

.

Definitions:

Toddler

A young child, typically between the ages of one and three years, who is learning to walk and engage in more complex activities.

Extremities

The limbs or appendages of the body, specifically arms, hands, legs, and feet.

Vision Acuity

The clarity or sharpness of vision, usually measured by the ability to discern letters or numbers at a standardized distance on an eye chart.

Preschool

An educational establishment or learning space offering early childhood education to children prior to the commencement of compulsory education at primary school.

Q3: "Tracking" is when educators place students into

Q3: For the logarithmic model y = β<sub>0</sub>

Q12: During the mid-nineteenth century,the working class consisted

Q55: Consider the following table providing the prices

Q60: A researcher gathers data on 25 households

Q64: Suppose that we have a qualitative variable

Q72: Exhibit 17.9.A bank manager is interested in

Q74: A wavelike movement in residuals suggests positive

Q75: Consider the following table that provides the

Q93: For the logarithmic model y = β<sub>0</sub>