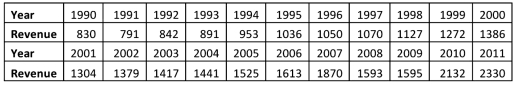

Exhibit 18.3.The following table shows the annual revenues (in millions of dollars) of a pharmaceutical company over the period 1990-2011.

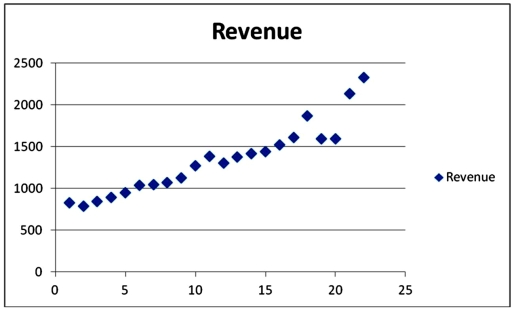

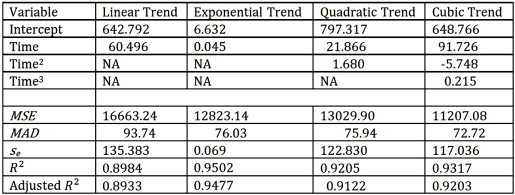

Excel scatterplot shown above indicates that the annual revenues have an increasing trend.Therefore,linear,exponential,quadratic and cubic models were used to fit the trend,and the following relevant information became available after applying linear regression.

Excel scatterplot shown above indicates that the annual revenues have an increasing trend.Therefore,linear,exponential,quadratic and cubic models were used to fit the trend,and the following relevant information became available after applying linear regression.  Refer to Exhibit 18.3.What is a linear trend equation?

Refer to Exhibit 18.3.What is a linear trend equation?

Definitions:

Income Tax Schedules

Tables or charts that determine the amount of tax payable based on income levels, incorporating various tax rates and brackets.

Economy

A system of production, distribution, and consumption of goods and services within a geographical, political, or social context.

Ability-To-Pay Taxation

A taxation principle that suggests taxes should be levied based on an individual's or entity’s capacity to pay, focusing on fairness and equity.

Income Receivers

Individuals or entities that receive income through various means such as employment, investments, or ownership of resources.

Q6: Exhibit 19-5.Firms A,B,and C operate in the

Q14: In research on middle-class families,this group appears

Q23: In regression,multicollinearity is considered problematic when two

Q29: Distinguish between the following classes: working class,working

Q30: What is the purpose of hyping bad

Q50: Amy Peterson's annual salary when she started

Q52: The sample correlation coefficient cannot equal zero.

Q83: Suppose the price of a slice of

Q87: Exhibit 20.11.A wine magazine wants to know

Q87: Exhibit 16.2.Typically,the sales volume declines with an