Exhibit 18.7.The following table shows the annual revenues (in millions of dollars)of a pharmaceutical company over the period 1990-2011.  The autoregressive models of order 1 and 2,

The autoregressive models of order 1 and 2,  and

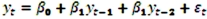

and  ,were applied on the time series to make revenue forecasts.The relevant parts of Excel regression outputs are given below.

,were applied on the time series to make revenue forecasts.The relevant parts of Excel regression outputs are given below.

Model AR(1):  Model AR(2):

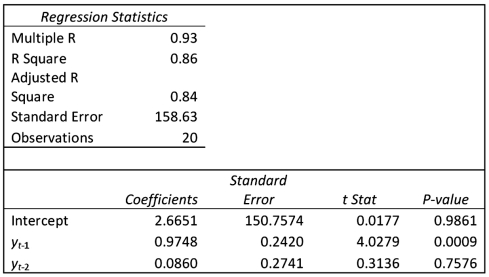

Model AR(2):  Refer to Exhibit 18.7.When for AR(1),H0: β0 = 0 is tested against HA: β0 ≠ 0,the p-value of this t test shown by Excel output is 0.9590.This could suggest that the model

Refer to Exhibit 18.7.When for AR(1),H0: β0 = 0 is tested against HA: β0 ≠ 0,the p-value of this t test shown by Excel output is 0.9590.This could suggest that the model  .might be an alternative to the AR(1)model

.might be an alternative to the AR(1)model  .Excel partial output for this simplified model is:

.Excel partial output for this simplified model is:  Find the revenue forecast for 2012 through the use of

Find the revenue forecast for 2012 through the use of  .

.

Definitions:

Filing Decision

The process of determining how and where to organize documents or data, typically for easy retrieval.

Charting

Process that lays out a chronological account of the patient reports, provider’s evaluation, prescribed treatment, and responses to treatment as well as the need for further follow-up.

Clinician

A healthcare professional who works directly with patients in diagnosing and treating illness and disease.

Paper Medical Records

Traditional forms of keeping patient's health information and history on paper, as opposed to digital formats.

Q12: Exhibit 20.9.A shipping company believes there is

Q13: Exhibit 14-3.Consider the following sample regression equation

Q15: Exhibit 19-2.Hugh Wallace has the following information

Q34: Assume you ran a multiple regression to

Q38: Exhibit 15-1.An marketing analyst wants to examine

Q54: When the null hypothesis is rejected in

Q67: Exhibit 16.5.The following data shows the demand

Q95: Exhibit 20.8.A sports agent wants to understand

Q95: The following portion of regression results was

Q102: Consider the following sample data: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2339/.jpg"