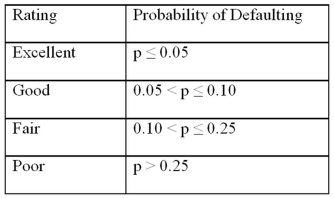

Exhibit 17.9.A bank manager is interested in assigning a rating to the holders of credit cards issued by her bank.The rating is based on the probability of defaulting on credit cards and is as follows.  To estimate this probability,she decided to use the logistic model:

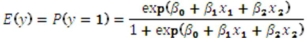

To estimate this probability,she decided to use the logistic model:  ,

,

where,

y = a binary response variable with value 1 corresponding to a default,and 0 to a no default,

x1 = the ratio of the credit card balance to the credit card limit (in percent),

x2 = the ratio of the total debt to the annual income (in percent).

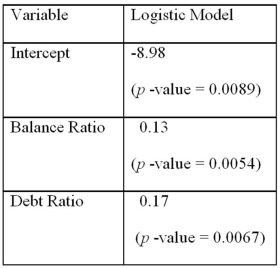

Using Minitab on the sample data,she arrived at the following estimates:  Note: The p-values of the corresponding tests are shown in parentheses below the estimated coefficients.

Note: The p-values of the corresponding tests are shown in parentheses below the estimated coefficients.

Refer to Exhibits 17.9.What will be the rating for a person with a balance ratio of 15% and a debt ratio of 30%?

Definitions:

Absorption Costing

An accounting method that includes both variable and fixed manufacturing costs in the cost of a product.

Net Operating Income

The profit realized from a business's operations after subtracting operating expenses but before deducting taxes and interest.

Variable Costing

A cost accounting method that includes only variable production costs (direct materials, direct labor, and variable manufacturing overhead) in product costs and treats fixed manufacturing overhead as a period expense.

Net Operating Income

The profit a company makes after deducting operating expenses but before interest and taxes from its total revenue.

Q10: Exhibit 16-7.It is believed that the sales

Q18: Which of the following statements is true

Q36: Jake Morris invested $150 in buying a

Q37: Exhibit 19-4.Consider the following data on the

Q41: Exhibit 20.1.A pawn shop claims to sell

Q54: Exhibit 20.6.A fund manager wants to know

Q59: Another name for an explanatory variable is

Q69: Exhibit 16-7.It is believed that the sales

Q79: The cubic regression model,y = β<sub>0</sub> +

Q93: Exhibit 12.2 A university has six colleges